TON = Apple iOS, Every other Chain = Blackberry

Why Grow Studio is Going All In on Telegram and Its TON Blockchain

Lend me your ears, I have a story to tell.

Close your eyes and picture this;

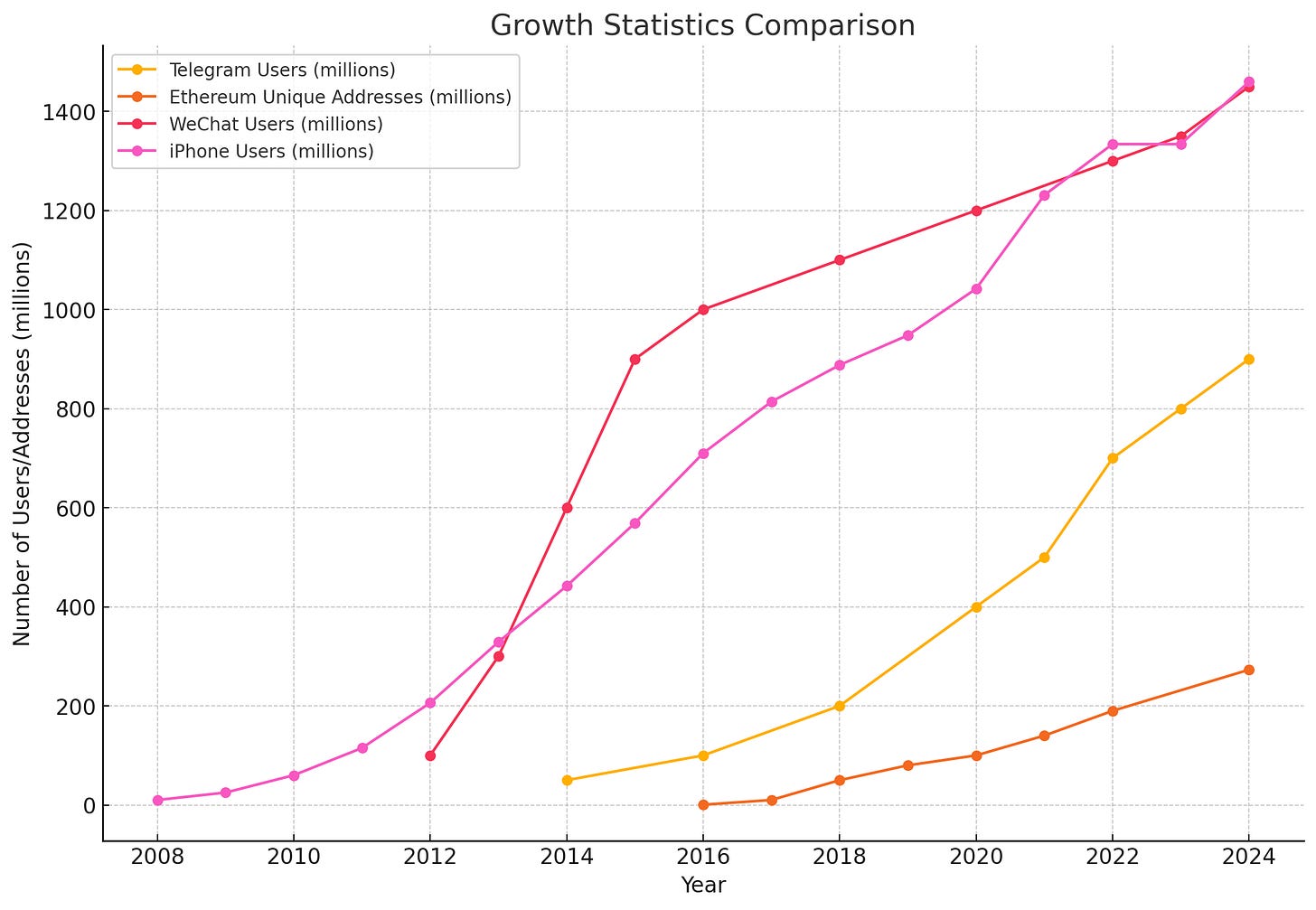

It’s the year 2030, and Solana’s very own Web3-centric SAGA Mobile device has almost a billion users. Since it launched in 2023, it has successfully captured market share from the Apple iPhone by persuading its 1.45 billion device owners to switch to SAGA because it enabled those people to access sick NFTs and chat with their crypto bros without the fear of Apple shutting them down.

Solana did it: They put Web3 in the pocket of a billion consumers and offered its utility as an optional feature to improve the consumer experience.

Ok, now wake up!

Let’s face it, that’s never happening, no matter how valiant the effort.

Now try this: let’s swap out a single word from that final sentence and see how it takes us from futuristic fantasy to present-day reality;

Telegram did it; they put Web3 in the pocket of a billion consumers and offered its utility as an optional feature to improve the consumer experience.

Since 2016, when I first entered a Telegram channel in search of some crypto degeneracy, I've always sought to deeply understand the innovation surrounding me. Like most participants in the space, the questions I’ve asked have evolved over time, this is a short summary of those in my early years;

2016: Wen mewn?

2017: Wen lambo?

2018: Why dumping?

2019: Wen price go back up?

These are important questions, no doubt, but when things started picking up again at the start of 2020, I decided to take a deeper dive into exactly what generates value in crypto.

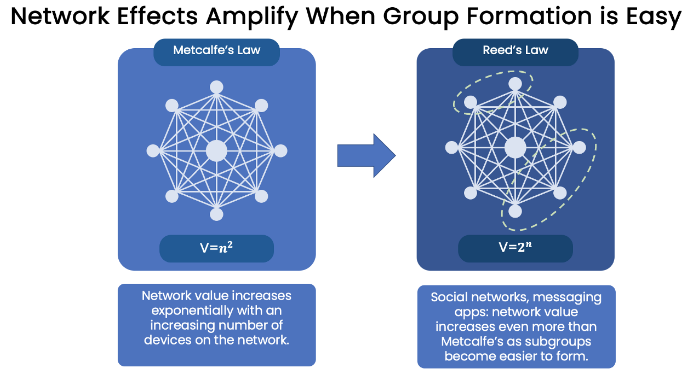

A Fascination with Network Effects

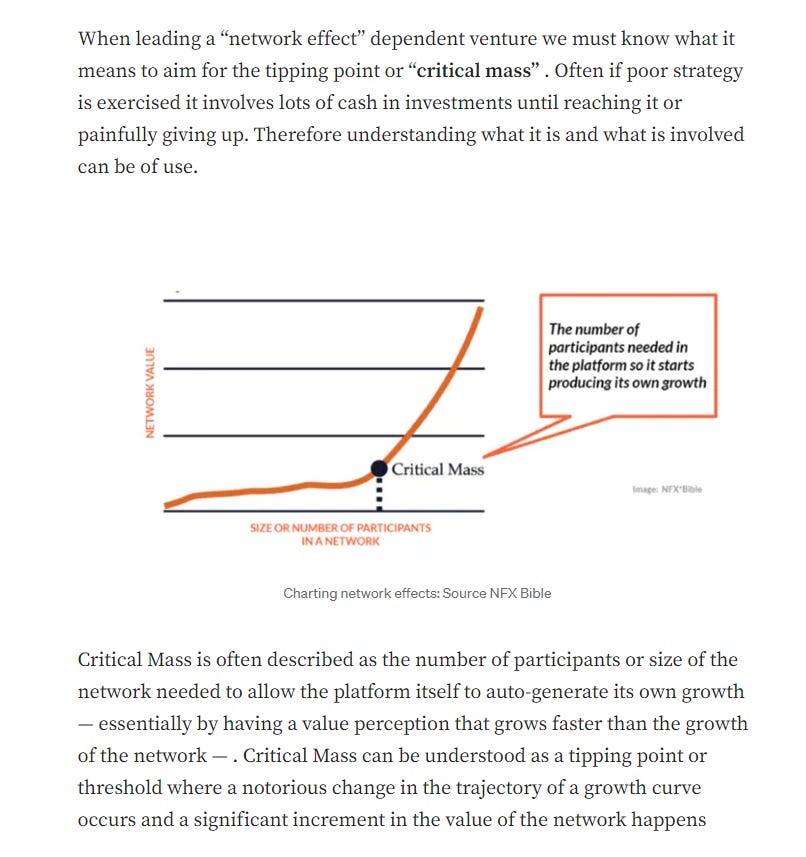

In July of 2020, as an amateur/hobbyist writer, I often attempted to convey my thoughts around a particular topic that fascinated me when looked at through the lens of crypto/Web3: Network Effects. The image below is my early basic understanding of the principles that I could see and was attempting to articulate via my personal blog;

Understanding Network Value

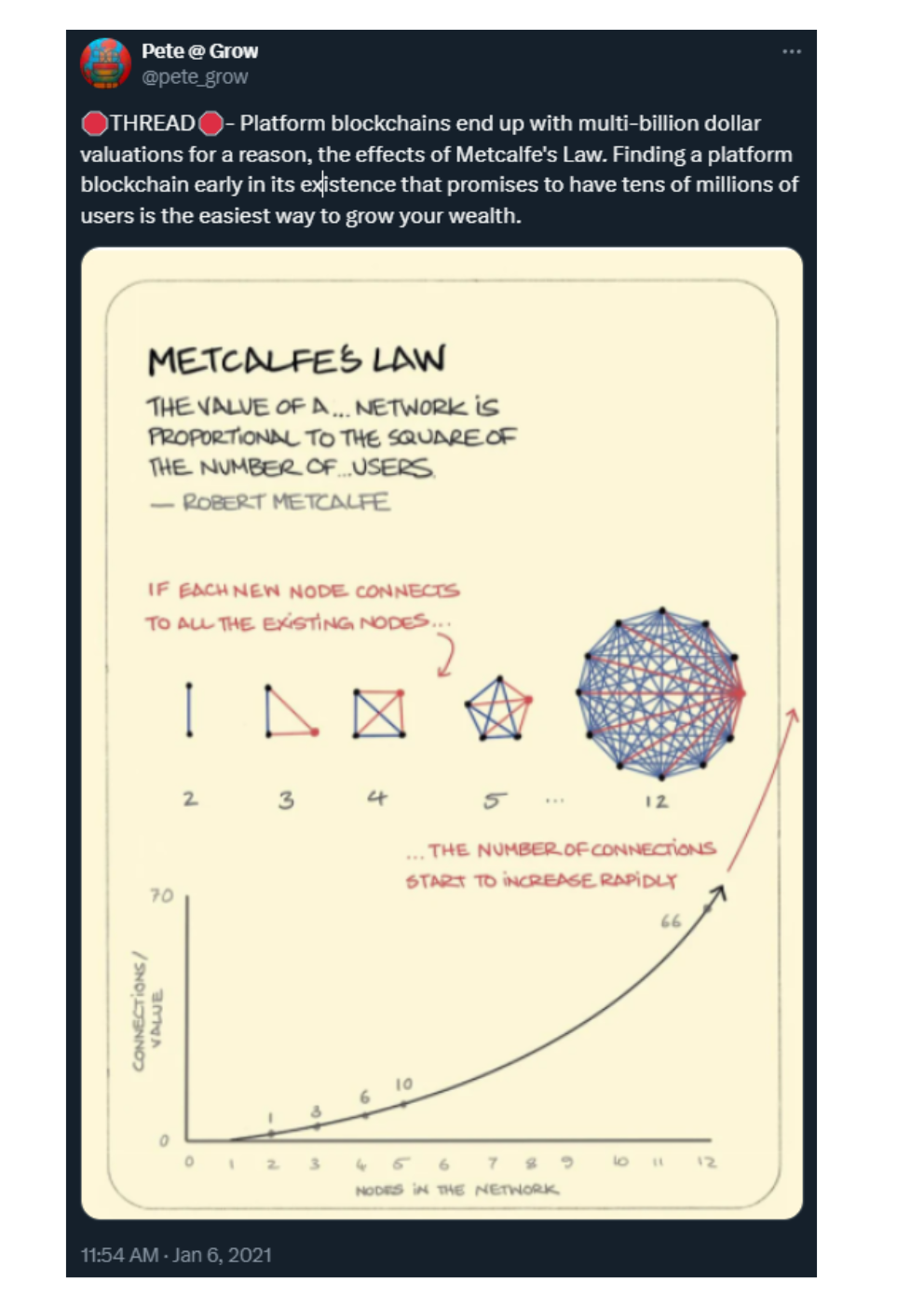

Back then, my limited understanding but deep interest had led me to constantly evaluate opportunities based on the potential of Network Effects because it was obvious that traditional valuation metrics often fall short in the world of digital networks. Instead, the true value of a network is best understood through the lens of network science.

The Bear Market Provided Lessons on Network Growth in Web3

As the hype of Web3 Gaming began to fade at the end of 2022, I wanted to understand why certain projects whose social media vanity metrics painted a picture of establishing early signs of Network Effects were suddenly down 90%+ in token value. I decided to self-fund a personal learning program via Maven and the fascinating thought leader Sameer Singh, who was lecturing on the subject of Applied Network Effects. The course opened my eyes to the complexities involved with Network Effects and the nuances dictating success in their establishment.

I spoke to the subject in 2023 at the AVAX Summit;

Web3’s Distribution Issue is Halting Strong Network Effects

Developers across multiple chains have knowingly or unknowingly attempted to solve the silo/fragmentation issue when it comes to the consumer layer by launching tokens to attract users, but when the price fades, so do the users.

Some have attempted different approaches to gathering a consumer base, we can look at Developers creating Ethereum-based social networks such as Lens, Farcaster, and at least 57 others for proof of this.

Despite these efforts, none of these Web3 social networks have scaled substantially enough to reach anywhere close to a mass adoption tipping point.

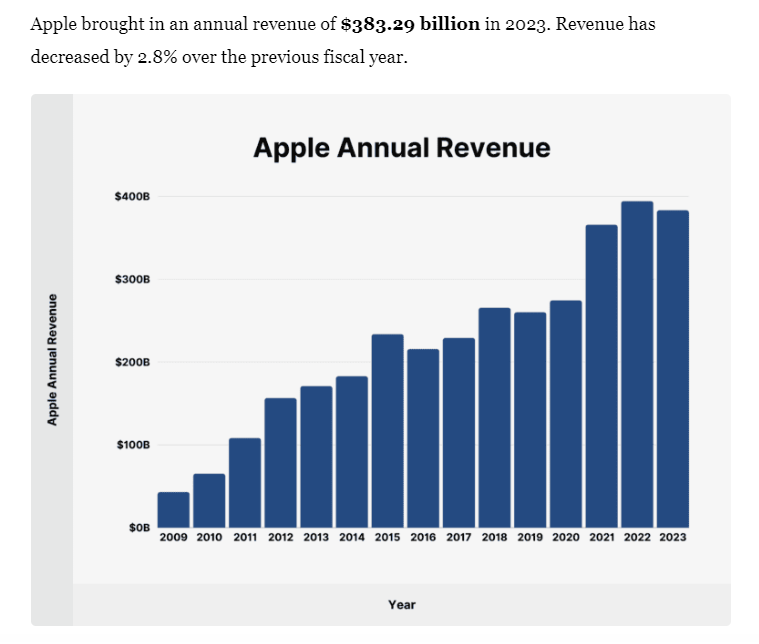

Telegram: Drawing Parallels With Apple and The App Store Revolution

When Apple launched the App Store in 2008, it revolutionized the mobile application market. The App Store provided a centralized platform where developers could easily distribute their apps, and users could conveniently discover and download them. This ecosystem created immense value for both sides of the marketplace:

Developer Empowerment: Digital start-ups and developers gained access to a global audience, tools for app development, and a straightforward monetization model. Early adopters who recognized the App Store’s potential built some of the market's most successful and enduring apps.

Consumer Convenience: The App Store offers users a seamless experience to explore, purchase, and manage apps. The ease of access and secure transaction system fostered a robust app economy, driving massive user engagement and satisfaction.

Before Apple launched the iPhone in 2007, it had already sold hundreds of millions of iPods. By integrating that device’s utility directly into the new device with the iPod App, it offered consumers a way to improve their daily interactions with technology. No need to turn on the TV to find out the weather forecast or go to the kitchen to check the calendar hanging on your fridge.

At that time, Blackberry owned the market when it came to mobile email with its business-focused smartphone, but if its fate wasn't doomed from day one of the iPhone launch, it was certainly doomed a little over a year later when Apple took things to another level by opening the iOS App Store to third-party Developers.

The major key to success here IMO demonstrates something very exciting for what we believe is currently unfolding at Telegram + TON Blockchain:

Apple had an established consumer base, which meant it was not suffering from the chicken and egg problem that caused so many Network Effects Ventures to fail. An established user base meant that developers flooded in to build apps, and more utility for users came with more apps, further attracting more users.

This flywheel is the only way to reach critical mass, and unfortunately, most platform blockchains (if not all) will fail to ever reach critical mass in consumer applications for Web3.

Simply put, there are too many costs to “switching” for consumers when having to deal with Web3 consumerism, and please don’t just take it from me, I found this golden example of that cost from the Founder of Solana himself when discussing the utility of his own product, The Solberry;

Ethereum, Layer 2’s and 3’s, Solana; if Apple’s consumer base is the Egg and third-party Developers are the Chicken, then all of these chains started with the Chicken, and it’s not gonna produce a lot of eggs.

Telegram: The Golden Egg

Fast forward to today, and Telegram is set to do for Web3 what the App Store did for mobile apps. Here’s how:

A Centralized Platform for Decentralized Applications: Telegram’s Mini-App platform serves as a centralized hub for decentralized applications (DApps). Just as the App Store provided a marketplace for mobile apps, Telegram offers a curated ecosystem where users can discover and interact with a variety of Web3 applications.

Developer Empowerment: Telegram’s Mini-App platform empowers developers by providing the tools and infrastructure needed to build, deploy, and monetize their applications. The integration with the TON blockchain further enhances this by enabling seamless financial transactions and secure data management. For Grow Studio, this means we can focus on creating innovative gaming experiences.

Consumer Convenience and Trust: Telegram’s user-friendly interface and robust security measures offer consumers a trusted environment to explore and use Web3 applications. The ease with which users can transition from messaging to engaging with Mini-Apps mirrors the convenience that the App Store brought to mobile users.

Financial Opportunities on Telegram’s Mini-App Platform

Similar to how the App Store opened up new revenue streams for developers, Telegram’s Mini-App platform offers various monetization models:

Telegram Stars for In-App Purchases: Telegram Stars enable easy in-app purchases, much like how the App Store facilitates app sales and in-app purchases. This allows businesses to monetize their applications effectively within the Telegram ecosystem.

Ad Revenue Sharing: Telegram’s revenue-sharing model allows channel and Mini-App owners to earn 50% of ad revenue, similar to how app developers earn from ads on their apps. This provides a sustainable income stream for developers and content creators.

Wallet and Trading Bots: The integration of wallet and trading bots simplifies in-app spending and trading, making it more accessible for users to engage in financial transactions. This functionality parallels the seamless transaction experiences in the App Store.

High Revenue Share for Creators: Telegram’s model allows creators to earn 95% of the revenue from sticker sales, akin to the App Store’s revenue share for app purchases. This high percentage incentivizes creators to develop unique content, driving more engagement and revenue.

USDT Payments: The acceptance of USDT payments opens up monetization to large pools of user liquidity, similar to how the App Store supports multiple payment methods to facilitate app purchases globally.

The Standout Opportunity for Founders

For founders like myself and many others aiming to reach a mass market, Telegram’s Mini-App platform offers unmatched opportunities, much like the App Store did in its early days:

Intrinsic User Base Connection: Telegram’s vast and engaged user base provides a ready market for Web3 applications. This intrinsic connection reduces the need for extensive user acquisition efforts, allowing founders to focus on building and scaling their businesses.

Seamless Financial Layer Integration: No other blockchain platform offers such a seamless integration of communication and financial transactions. This harmonized ecosystem simplifies the user experience, making it easy for consumers to engage with Web3 technologies.

Network Effects Amplifying Growth: Telegram's network effects amplify the growth of any integrated application. As more users engage with these applications, the value and utility of the platform increase, driving further adoption in a positive feedback loop.

Supporting Data for Reed’s Law Network Effects in the Context of TON and Telegram

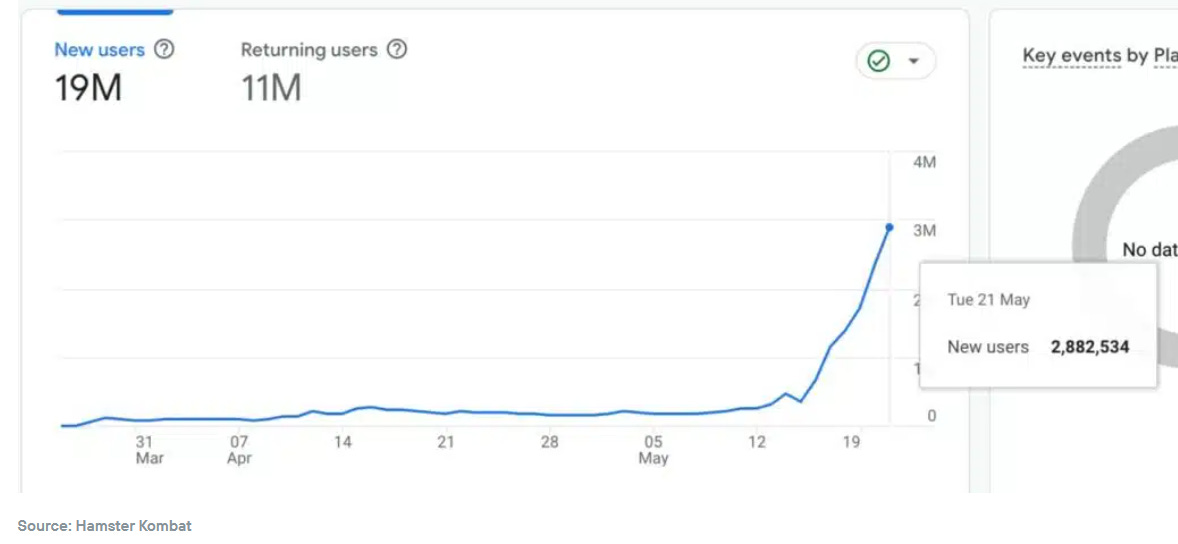

Daily Active Users (DAU) Growth:

Start of 2024: 10,000 DAU

Mid-2024: 350,000 DAU

Growth: 35x increase in six months

Implication: Rapid growth in DAU indicates strong user engagement and the potential for forming numerous sub-groups, a key aspect of Reed's Law, which scales much faster than Metcalfes. As more users join, the number of possible sub-groups grows exponentially, increasing the network's value.

Transaction Volume Surge:

Q2 2024: Transaction volume surged to $1.6 billion

Implication: High transaction volumes suggest active user participation in economic activities within the network. The ability to conduct transactions within sub-groups enhances network value by facilitating trade and collaboration.

Total Value Locked (TVL):

March 1, 2024: $22 million

Today: Over $600 million

Growth: 27x increase in a few months

Implication: A substantial increase in TVL reflects growing trust and investment in the network. The presence of multiple sub-groups managing and growing their assets further amplifies the network's overall value.

Holder Count Increase:

One Year Ago: 2.9 million holders

Today: 32 million holders

Growth: 11x increase in one year

Implication: Many holders indicate widespread adoption and the formation of various sub-groups or communities. Each new holder potentially creates or joins a sub-group, exponentially increasing the network's value.

Price Growth:

August 2023: $1.20

Today: $7.12

Growth: Nearly 6x increase in 10 months

Implication: The rising price of TON tokens reflects increased demand and network utility. The formation of sub-groups within the network can drive specific use cases and applications, further increasing token value.

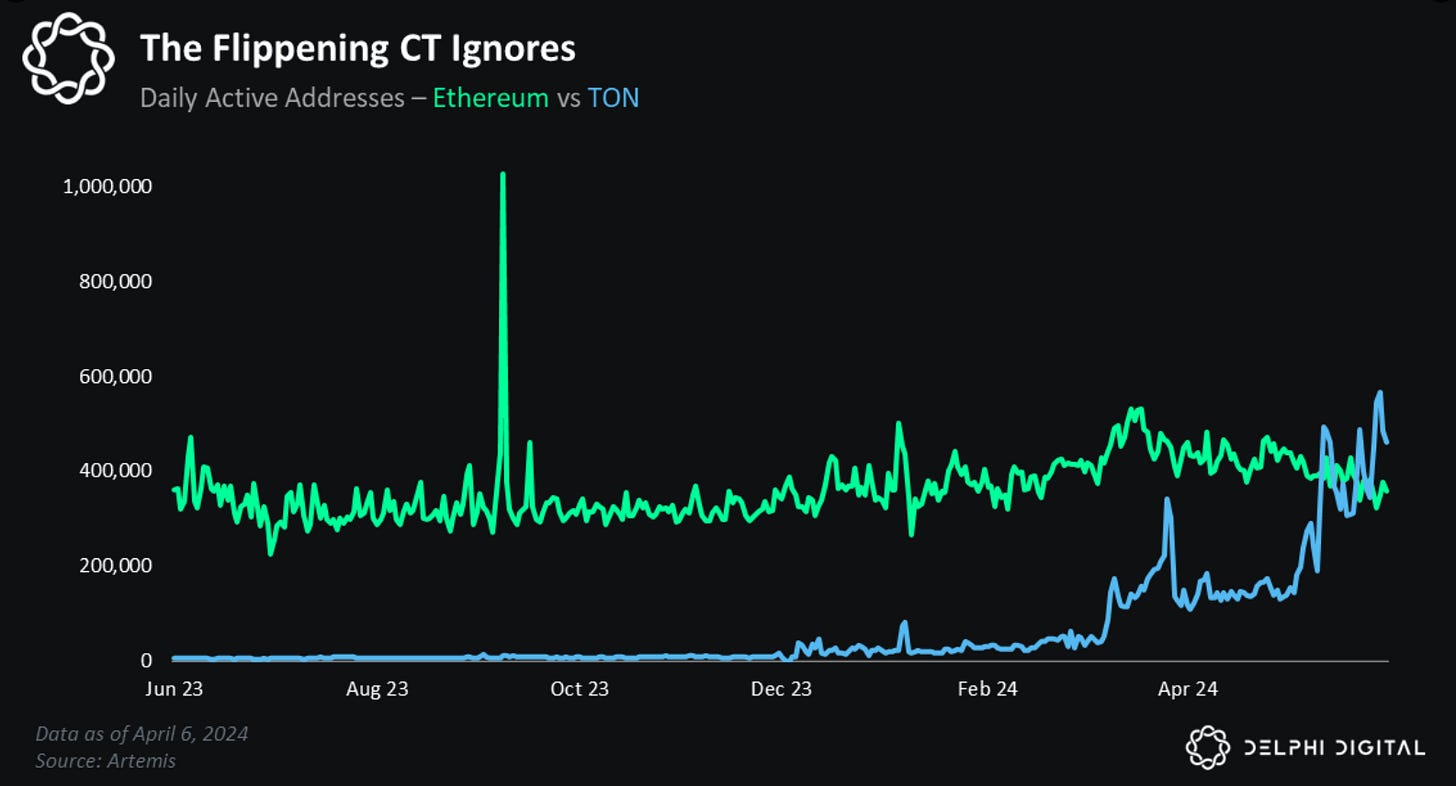

Daily Active Addresses (DAA) Comparison with Ethereum:

Data from April 6, 2024: Daily active addresses for TON have surpassed Ethereum, driven by Telegram's 900M user base beginning to see the extra utility available.

Implication: Higher DAA for TON indicates more frequent and diverse interactions within the network. The formation of numerous sub-groups enhances overall network value, as described by Reed's Law.

Crypto/Web3 Communities in Telegram:

Estimated 37,000 Crypto/Web3 communities: These communities represent diverse interests and activities within the broader network.

Implication: The large number of crypto/Web3 communities within Telegram supports the exponential growth of network value through sub-group formation and collaboration, aligning perfectly with Reed’s Law.

If you made it all the way to this paragraph, fair play! Thank you for reading; I truly hope that no Solana or Ethereum superfans were hurt in the process; a rising tide lifts all boats, after all.

Next week I will share details on how Grow Studio aims to leverage the Network Effects described above and bring fun, rewarding and new experiences to the Telegram community.

Until next time, we’ll probably be skating :)

https://growstudio.io

https://plankpushers.xyz